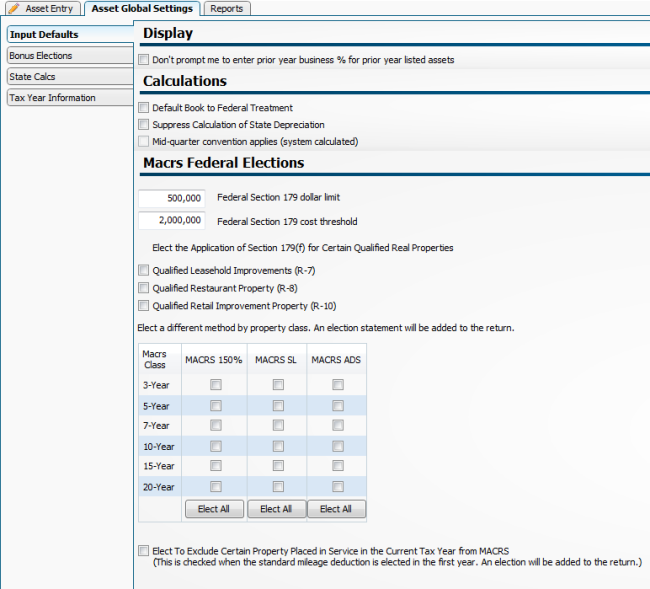

Input Defaults

The Input Defaults tab (under Asset Global Settings) allows you to setup defaults on a client by client basis.

Input Defaults tab (Asset Global Settings)

Display

Select the check box to disable the automatic prompt regarding prior year business % when entering prior year listed assets.

Calculations

Default Book to Federal Treatment, select the check box to have book depreciation default to Federal treatment.

Select the check box to suppress the calculation of state depreciation (for example if the state is a non-tax state). The mid-quarter convention box is non-editable and will be checked if mid-quarter convention applies.

MACRS Federal Elections

The Federal Section 179 dollar limit and cost threshold: Program updates will automatically keep these limits current with federal legislation but you can override the system defaults on a per return basis as desired.

MACRS Elections for 150%, SL or ADS: Select from one of these elections per recovery period or class to default all new assets with the selected method.

See Also: